Special Services

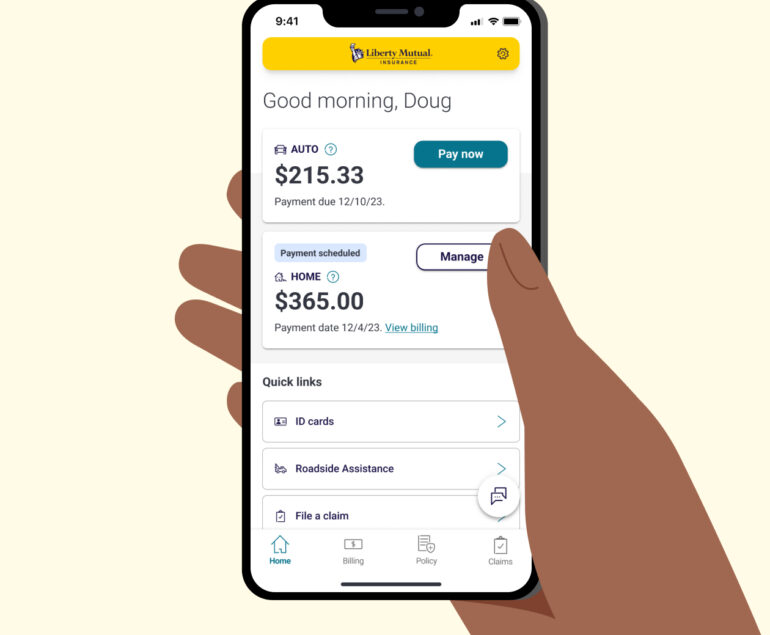

Insure Your Hustle.

Calculate Your Rate

Join thousands of independent workers who trust Liberty Gig Insurance.

A name you know and trust. We bring decades of insurance expertise to the gig economy.

Who We Cover

24

Years of advisory experience

550 +

Loans borrowing

650 +

Success Projects

850 +

Happy Clients

Get to Know About

We're Releasing All Personal

Wishes is Like.

Fair interest Rates.

Business Loan Options for Policyholders

Exclusive Financing Solutions for Insured Business Owners

At Liberty Gig Insurance, we don’t just protect your business — we help it grow. As part of our commitment to supporting independent workers and small business owners, we offer exclusive business loan options to clients who are covered under our insurance policies.

Whether you’re launching a new venture, expanding operations, or simply navigating seasonal cash flow challenges, our business loans are designed with flexibility, speed, and ease in mind.

Our manager will contact you

Presenting Banking Plan & Services

💼 What Makes Our Loans Different?

✔️ Lower Rates for Policyholders

Enjoy preferential interest rates as a Liberty Gig Insurance customer — starting as low as 3.74%.

✔️ Streamlined Approval Process

Your insurance policy with us simplifies the loan verification and approval process. Get approved in as little as 7 days.

✔️ Flexible Repayment Terms

Choose a loan term that fits your business needs — from short-term working capital to long-term expansion plans (up to 30 years).

✔️ Borrow Up to $5 Million

Access the capital you need, with loan amounts ranging from $10,000 to $5 million, depending on your eligibility and coverage.

Fair interest Rates.

Personal Loan Options for Policyholders

Financial Freedom Backed by Insurance Confidence

At Liberty Gig Insurance, we understand that life happens — and when it does, you deserve quick, affordable financial support. That’s why we offer exclusive personal loan options to individuals who hold an active insurance policy with us.

Whether you’re managing an unexpected expense, funding education, consolidating debt, or planning a big purchase, we provide access to personal loans designed with flexibility, simplicity, and speed.

Our manager will contact you

Presenting Banking Plan & Services

💸 Why Choose Our Personal Loans?

✔️ Lower Interest Rates for Policyholders

Eligible clients receive preferred rates, starting from just 3.74% APR.

✔️ Fast Funding, When You Need It Most

Pre-qualified policyholders can receive funding in as little as 24–72 hours after approval.

✔️ Flexible Loan Amounts

Borrow from $5,000 to $100,000 based on your coverage and financial profile.

✔️ No Hidden Fees or Surprise Charges

Transparent terms, with no prepayment penalties or hidden processing costs.

Fair interest Rates.

Payday Loans for Gig Workers & Freelancers

Instant Cash When You Need It Most – Backed by Your Insurance

Life doesn’t wait for payday — and neither should you. At Liberty Gig Insurance, we offer fast and secure payday loan options exclusively for our insured clients. Whether it’s an unexpected bill, a family emergency, or just a temporary cash gap, our payday loans are designed to provide quick access to funds when you need them most.

Our manager will contact you

Presenting Banking Plan & Services

Why Choose Liberty Gig Payday Loans?

✔️ Same-Day or Next-Day Funding

Apply today, get paid as soon as 24 hours — sometimes even faster.

✔️ No Credit Check Required

We focus on your current income and insurance coverage, not your credit history.

✔️ Borrow Up to $1,500

Short-term, small-dollar loans to help bridge the gap until your next payday.

✔️ Automatic Repayment

Simple, scheduled repayments to avoid missed payments or penalties.

Fair interest Rates.

🎓 Education Loans for Freelancers & Gig Workers

Invest in Your Skills. Secure Your Future.

At Liberty Gig Insurance, we believe that education is one of the smartest investments you can make — especially in today’s competitive, ever-evolving gig economy. That’s why we offer flexible, affordable education loans exclusively for our insured clients.

Whether you’re looking to sharpen your skills, earn a certification, or return to school, our education loans help you upgrade your career without compromising your finances.

Our manager will contact you

Presenting Banking Plan & Services

📚 Why Choose Liberty Gig Education Loans?

✔️ Flexible Loan Amounts

Borrow between $1,000 and $50,000 depending on your program and needs.

✔️ Low, Fixed Interest Rates

As an insured client, you enjoy preferred rates starting at just 3.74% APR.

✔️ Deferred or Flexible Repayment Options

We offer grace periods and income-based repayment to fit your earning cycles.

✔️ Covers a Wide Range of Programs

Use your loan for certifications, trade schools, online courses, part-time or full-time degrees, and more.

Fair interest Rates.

🏠 Home Loans for Independent Workers

Your Path to Homeownership Starts Here

At Liberty Gig Insurance, we believe that stable, independent income shouldn’t hold you back from owning a home. That’s why we’ve created a flexible, gig-friendly home loan program — exclusively available to clients with an active Liberty Gig Insurance policy.

Whether you’re buying your first home, refinancing, or upgrading, we offer tailored mortgage solutions that make homeownership accessible for self-employed professionals, freelancers, and gig workers.

Our manager will contact you

Presenting Banking Plan & Services

✅ Why Choose Liberty Gig Home Loans?

✔️ Low Rates for Insured Clients

Enjoy competitive interest rates, starting as low as 3.74% APR.

✔️ Flexible Income Verification

We understand 1099s, app payouts, and freelance contracts — no traditional W-2 required.

✔️ Loans Up to $5 Million

From starter homes to dream properties — we’ll help you fund it.

✔️ Extended Loan Terms

Choose terms of 10 to 30 years to match your financial goals.

✔️ Down Payment Assistance (for eligible borrowers)

Get help with upfront costs if you’re a first-time buyer.

Customers Testimonials

What client say about us.

“After my car accident, I thought I’d lose everything. But Liberty Gig’s income protection kicked in fast and covered my bills while I recovered. I felt truly supported — not just insured.”

“Being self-employed, I never thought I’d qualify for a personal loan. Liberty Gig not only approved me — they gave me a great rate and fast funding. Now I can invest in better tools and grow my business.”

“I signed up for their business liability insurance because a client required it. It ended up saving me from a huge legal headache when a job site incident happened. Worth every penny.”

Client 10

Client 9

Client 8

Client 7

Client 6